守势相对定单

守势相对定单为交易者提供了一种寻求比全国最佳买卖价(NBBO)保守的价格,同时保持定单与最佳出价(对买单)或最佳要价(对卖单)挂钩的方法。定单价格按市场的变化获自动调整以保持定单的保守价格。对买单,您的定单价格与带有一个保守抵消额的NBB(全国最佳出价)挂钩,如果NBB上涨,您的出价也随之上涨。如果NBB下跌,将不做调整,否则的话您的定单将变为积极的并被执行。对卖单,您的价格与带有保守抵消额的NBO(全国最佳要价)挂钩,如果NBO下跌,您的出价也可随之下调。如果 NBO上涨,将没有价格调整,否则的话您的定单将成为积极的并获执行。除了抵消额外,您可以设定一个绝对上限,该上限可以做为一个限价,并将防止您的定单以高于或低于某个特定水平被执行。守势相对定单与相对/挂钩定单相似,不同之处仅在于守势相对定单买价减去抵消额,相对定单买价加上抵消额。

| 产品 | 可用性 | 传递 | TWS | ||||

|---|---|---|---|---|---|---|---|

| 股票 |  |

美国产品 |  |

智能 |  |

属性 |  |

| 权证 |  |

非美国产品 |  |

直接 * |  |

定单类型 |  |

| 有效时间 |  |

||||||

| *仅用于直接传递到ISLAND的定单 带有"0"抵消额的定单以最佳买/卖价按限价单提交,并将随市场上下波动来保持与内部报价的匹配。 |

|||||||

举例

Order Type In Depth - Passive Relative Buy Order

Step 1 - Enter a Passive Relative Buy Order

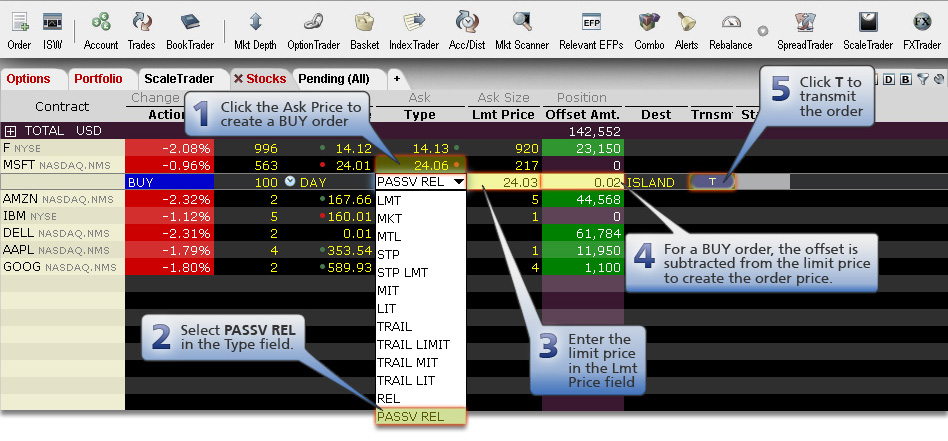

When you use a Passive Relative order, the value in the Limit Price field becomes the price cap, and the order price is calculated (but not displayed) using the NBB minus the offset amount (the relative amount) for a buy order, and the NBO plus the offset amount for a sell order. You want to buy 100 shares of XYZ, and you want to place a less aggressive bid than the current best bids to increase your chance of filling at a better price.

The current NBBO for shares of of XYZ stock is $24.01 - 24.06. You create a buy order for 100 shares and select PASSV REL as the order type. You enter 24.03 as the limit price, which is the price cap for your order; this is the most you are willing to pay. You enter an offset amount of 0.02, then transmit the order.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 100 |

| Order Type | PASSV REL |

| Market Price (NBBO) Range | $24.01 - 24.06 |

| Limit Price (Price Cap) | 24.03 |

| Offset (Relative) Amount | 0.02 |

Step 2 - Order Transmitted

Your order is initially submitted with a bid of $23.99 (NBB of 24.01 - 0.02 offset amount), which is less aggressive than the NBB of $24.01.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 100 |

| Order Type | PASSV REL |

| Market Price (NBBO) Range | $24.01 - 24.06 |

| Limit Price (Price Cap) | 24.03 |

| Offset (Relative) Amount | 0.02 |

| Bid | 23.99 |

Step 3 - Price Rises, Order is Not Executed

The market rises and the NBBO for shares of XYZ rises to $24.03-$24.08. Your bid moves with it to $24.01. The order does not execute. If the market continued to rise to $24.03-24.07, your bid would be capped at $24.03.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 100 |

| Order Type | PASSV REL |

| Market Price (NBBO) Range | $24.03 - 24.08 |

| Limit Price (Price Cap) | 24.03 |

| Offset (Relative) Amount | 0.02 |

| Bid | 24.01 |

Step 4 - Price Falls, Order is Executed

The market now falls and the NBBO for XYZ shares falls to $23.98-24.03. Your bid stays at $24.01 and executes at that price.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 100 |

| Order Type | REL |

| Market Price (NBBO) Range | $23.98 - 24.03 |

| Limit Price (Price Cap) | 24.03 |

| Offset (Relative) Amount | 0.02 |

| Bid | 24.01 |